What is the Envelope System?

- By Andrew Jacobs

- Feb 22, 2019

Being in my late 20’s (very sad to say), I try my hardest to keep my expenses down. At the same time, since I'm only in my late 20’s, I haven’t quite mastered this … yet at least.

Recently my mom mentioned the envelope system and I immediately thought of JAM … because, well, envelopes. But when she started to explain it, I became more and more interested for my personal gain as well. So I tried it, and let me tell you, it works if you work at it.

Some history if you’re into that: No one really knows who founded or started the envelope system. Some say it started early in the 1900's when the idea of the budget came about. Others say that Dave Ramsey, an American radio show host, was the one who really made the method popular.

What is the Envelope System?

The envelope system is a tangible way to budget monthly expenses without worrying about going over your set amount. Instead of guessing how much is in the bank or spit-balling the amount you want to spend during a single month, you’ll have the exact amount right in your hands (well, right in your envelopes).

The key to this is: CASH. I know, such a foreign idea nowadays, but it works!

STEPS FOR SUCCESS:

1. PLAN YOUR BUDGET

This is probably the most difficult task of them all, but once you get it down, it’ll be a piece of cake. The most important part of this step is to take your time! Really try to figure it out, no assumptions / conclusions allowed.

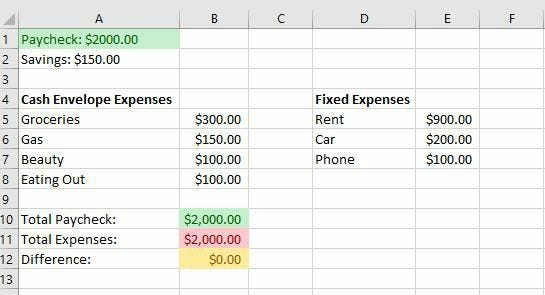

via GIPHYTIP: Always start with your monthly income and remember to subtract any amount you want to save (if possible). This is your total budget for everything you have to pay for. But this is NOT the amount you will put in your envelopes …

In other words, do not include your “fixed expenses” in this budget either. Fixed expenses are your phone bill, rent or mortgage, car payments, etc. and they should all be outside of this system (since you don’t want to carry around thousands of dollars in your wallet).

2. DIVIDE AND CONQUER

Once you decide on your monthly budget, separate the amount by category. Number one on your list should be groceries (which should include toiletry necessities). Gas should definitely be in there before everything else too! But the rest is up to you. Eat out a lot? Count that as one envelope. Need that mani/pedi every 2 weeks, another envelope. Etc. Etc. Etc.

TIP 1: Be realistic! Of course we would love to use our gas money only once a month, but if you drive a lot, you drive a lot. There’s nothing you can do (besides beg to work from home forever). If you drive a lot, try to cut down on how many times you eat out. This might be a good idea because your gas amount will go down too!

TIP 2: Still not sure? Write everything down in a notebook or an excel spreadsheet. Here’s what it should look like (all of the amounts are made up, if I told you my budget, you’d scream at my expenses):

3. GO TO THE DREADED PLACE ...

That’s right, the ATM. We rarely do this anymore as consumers, but it’s the absolute best way to visualize your budget. Get your set amount of cash out and begin!

4. GRAB SOME JAM ENVELOPES

Here’s where JAM comes in. Of course you can use commercial white envelopes but JAM brite hue #7 coin envelopes are the perfect fit. Literally! Our 3.5 x 6.5 envelopes perfectly fit dollar bills! (Trivia: a dollar bill measures in at 2.61 inches by 6.14 inches). And with our bright colors, you can color code your categories.

TIP: Let’s say you put your grocery cash in our brite hue blue envelope. From now on when you’re searching through the deep dark cave that is your purse, you can spot the amazing blue hue quickly and snatch it before the person in back of you starts tapping their foot and sighing obnoxiously for you to hurry up.

What if I spend all my cash for the month before the month is over?

The fact of the matter is, self-control is the most important trait to have during this process. Try your hardest not to go over. IF this happens, you have to take cash out from one of your (non-necessity) envelopes OR cut down somewhere the next month. Yes, this is super hard but once you gain that self-control, it’ll get easier. Or so we all hope.

Some examples of what I cut out of my life (sadly):

1. Dunkin' Coffee: So, I’m a Dunkin Donuts queen. I get coffee for my breakfast and a donut for my lunch (yes this is super healthy, thanks for noticing). When I calculated my budget and included my daily desire for DD, I realized how much money I was spending. At least $90 a month! Yep, I was that nuts for coffee. Meanwhile, we have a Keurig in our office (#DDcoffeeaddictproblems). I now cut that expense out of the picture all together and still get the same caffeine I need to survive the day.

2. Shoedazzle: I had a monthly subscription to this amazing site (for everyone who doesn't know, you get one pair of shoes each month for about $20.00) and it’s totally not needed. Cancelling my subscription was like THE hardest phone call I ever had to make but it was worth it.

3. Chili's: Everyone in the office knows it's my favorite place to eat (and they are probably rolling their eyes and/or laughing right now). Legitimately, I used to go maybe once a week or once every two weeks. If I did go once every week, it would add up to $40.76 (I always get big mouth bites, extra ranch, hold the bacon). That's a lot of cash I could save by eating a hot pocket instead. Did I mention I'm a healthy eater?

So, there you have it! The envelope system. Try it out for yourself! Let us know in the comment section how you feel about the method, any questions you have, your experiences, and (hopefully) your successes! We'd love to hear from you!

Understanding the Envelope System

The envelope system is a budgeting method that involves using cash for different spending categories and keeping the money in separate envelopes. This helps individuals to visually see how much money they have left for each category and prevents overspending. The system is a great way to control spending, save money, and avoid debt. By allocating a specific amount of cash to each envelope for expenses such as groceries, entertainment, and transportation, individuals can better manage their finances and prioritize their spending. The envelope system is a simple yet effective way to stay on track with budgeting and achieve financial goals.

Benefits of the Envelope System

One of the main benefits of the envelope system is that it promotes discipline and accountability when it comes to spending. It also helps individuals to become more aware of their spending habits and make conscious decisions about where their money goes. Additionally, the envelope system can be a great tool for those who struggle with overspending or have difficulty sticking to a budget. By using cash and physically seeing the money in each envelope, it becomes easier to avoid impulse purchases and unnecessary expenses.

Use Cases for the Envelope System

The envelope system can be used in various situations, such as managing household expenses, saving for specific goals, or controlling discretionary spending. It is particularly useful for individuals who prefer a tangible and visual approach to budgeting, as opposed to digital methods. The system can also be adapted to fit different lifestyles and financial situations, making it a versatile tool for anyone looking to improve their financial management skills.

Alternatives to the Envelope System

While the envelope system is effective for many people, there are alternative budgeting methods that may better suit others' preferences and needs. Some alternatives include the zero-based budget, the 50/30/20 rule, or using budgeting apps and software. It's important to explore different options and find the method that works best for individual financial goals and habits.

Tips for Using the Envelope System

When using the envelope system, it's important to regularly review and adjust the budget categories to ensure they align with current needs and priorities. It's also helpful to keep track of spending and make notes on each envelope to monitor where the money is going. Additionally, individuals should be flexible and open to making changes to the system as they learn more about their spending habits and financial goals.

Maximizing the Envelope System for Financial Success

To maximize the benefits of the envelope system, individuals can consider incorporating additional envelopes for specific savings goals, such as a vacation fund or emergency fund. This can help to further prioritize and allocate funds for long-term financial security and personal aspirations. By consistently using the envelope system and staying committed to budgeting, individuals can achieve greater financial stability and peace of mind.