Free ground shipping, excluding Alaska, Hawaii, and Canada

W-2 Envelopes

Designed to perfectly fit your tax documents, our specialized W-2 envelopes come with precisely positioned windows, ensuring that the address and information align seamlessly, negating the need for additional labeling. Crafted from durable 24lb paper, each envelope is sturdy enough to protect your sensitive tax information from the wear and tear of mailing. The security tint inside keeps the contents confidential, safeguarding your financial data. Available in a variety of sizes, including the standard 5 3/4 x 8 7/8 to 9 x 12 envelopes for larger tax return documents, ensuring a perfect fit for all your tax season correspondence. From the classic elegance of white and natural tones to the distinguished nautical navy blue and patriotic themes, our envelopes allow you to send your tax documents in style. The natural tax return presentation folders, complete with front card slits, add an extra layer of sophistication to your financial documentation. With peel & seal closures, securing your documents is quick and effortless, ensuring a tight seal that maintains the integrity of your contents throughout the mailing process. Whether you're a business sending out employee W-2 forms or an individual managing your tax returns, our W-2 envelopes provide a reliable, secure, and stylish solution for your mailing needs during the tax season. Choose our W-2 envelopes to convey professionalism, security, and attention to detail in your tax-related mailings.

W-2 Envelopes: A Comprehensive Guide

Key Summary:

- This article will explore the topic of W-2 envelopes, including their purpose, importance, and various use cases in the real world.

- Readers will learn about the different types of W-2 envelopes available and the features to consider when choosing the right one.

- Real world examples and practical tips on how to properly use and store W-2 envelopes will be provided for easy reference.

W-2 envelopes play a crucial role in tax season and document organization for businesses and individuals alike. Understanding the purpose and importance of W-2 envelopes is essential for ensuring the security and accuracy of sensitive information. In this comprehensive guide, we will delve into the different types of W-2 envelopes available, real world use cases, and provide practical tips on how to effectively use and store W-2 envelopes. By the end of this article, readers will have a thorough understanding of W-2 envelopes and their significance in tax preparation and document management.

What are W-2 Envelopes?

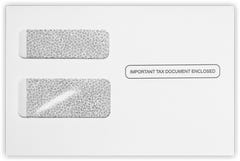

W-2 envelopes are specifically designed envelopes used to distribute W-2 forms to employees for tax reporting purposes. These envelopes are essential for securely delivering important tax documents to individuals, ensuring that sensitive information is protected during transit. The purpose of W-2 envelopes is to provide a designated space for W-2 forms to be enclosed and delivered to recipients in a confidential manner.

Definition and Purpose of W-2 Envelopes

W-2 envelopes are typically double-window envelopes that display the recipient's name and address, as well as the sender's information. This design allows for easy identification and ensures that the correct W-2 form is delivered to the intended recipient. The purpose of W-2 envelopes is to streamline the process of distributing tax documents and maintain the confidentiality of personal information.

Importance of Using W-2 Envelopes for Tax Documents

Using W-2 envelopes is crucial for businesses and individuals to comply with tax regulations and protect sensitive information. By utilizing W-2 envelopes, organizations can ensure that employees receive their tax forms securely and on time, reducing the risk of identity theft or fraud. The importance of using W-2 envelopes for tax documents cannot be overstated, as they play a key role in maintaining the integrity and security of personal financial information.

Types of W-2 Envelopes

There are various styles and sizes of W-2 envelopes available to meet different needs and preferences. From standard double-window envelopes to security-tinted options, choosing the right type of W-2 envelope is essential for ensuring the safe delivery of tax documents. When selecting W-2 envelopes, it is important to consider the features that will best suit your specific requirements.

Different Styles and Sizes of W-2 Envelopes Available

W-2 envelopes come in a range of styles, including self-seal, gummed flap, and security-tinted options. The size of W-2 envelopes can vary depending on the type of W-2 form being enclosed, with standard sizes available to accommodate different document dimensions. Choosing the right style and size of W-2 envelope is important for ensuring that tax documents are securely enclosed and delivered.

Features to Look for When Choosing W-2 Envelopes

When selecting W-2 envelopes, it is important to consider features such as security enhancements, window placement, and seal type. Security features like security tinting and tamper-evident seals can help protect sensitive information during transit. Window placement should align with the recipient's address on the W-2 form for easy identification. Considering these features when choosing W-2 envelopes can help ensure the safe and efficient delivery of tax documents.

Who Should Use W-2 Envelopes?

W-2 envelopes are designed for businesses, organizations, and individuals who need to distribute W-2 forms to employees for tax reporting purposes. This includes:

- HR departments

- Accounting firms

- Small business owners

- Individual taxpayers

Key Considerations:

- Businesses with employees

- Organizations that issue W-2 forms

- Individuals who receive W-2 forms

When to Utilize W-2 Envelopes?

W-2 envelopes should be used during tax season when distributing W-2 forms to employees for reporting income and taxes withheld. It is important to utilize W-2 envelopes:

- At the end of the calendar year

- When preparing tax documents

- When distributing W-2 forms to employees

Key Times to Use W-2 Envelopes:

- During tax season

- When issuing W-2 forms

- When mailing tax documents

Examples of W-2 Envelopes in Action

W-2 envelopes are commonly used in various scenarios to securely distribute tax documents and protect sensitive information. Some use case examples include:

Businesses Using W-2 Envelopes for Tax Season:

- HR departments mailing W-2 forms to employees

- Accounting firms sending tax documents to clients

- Small businesses distributing W-2 forms to contractors

Individuals Benefiting from Secure W-2 Envelopes:

- Employees receiving W-2 forms from employers

- Taxpayers mailing tax documents to the IRS

- Freelancers sending tax information to clients

What Sets Our W-2 Envelopes Apart?

Our W-2 envelopes are designed with security and convenience in mind, featuring tamper-evident seals and security tinting to protect sensitive information during transit. The double-window design ensures accurate delivery of W-2 forms, making it easy for recipients to identify and access their tax documents. Additionally, our W-2 envelopes are available in various sizes and styles to accommodate different document dimensions and mailing needs.

Enhanced Security Features

Our W-2 envelopes are equipped with advanced security features such as tamper-evident seals and security tinting to safeguard sensitive tax information during delivery. These security enhancements provide peace of mind knowing that your W-2 forms are protected from unauthorized access or tampering.

Convenient Design for Easy Use

The double-window design of our W-2 envelopes allows for seamless identification of recipient and sender information, streamlining the process of distributing tax documents. With easy-to-use features like self-seal or gummed flaps, our envelopes make it simple to securely enclose and seal W-2 forms for mailing.

Ways to Maximize the Benefits of W-2 Envelopes

To get the most out of your W-2 envelopes, follow these tips and best practices for using and storing tax documents:

Properly Fill Out and Seal W-2 Envelopes

When preparing W-2 envelopes, ensure that the recipient's address aligns with the window placement for accurate delivery. Fill out the sender's information clearly and securely seal the envelope to protect the contents during transit. Double-check the accuracy of the information before mailing to avoid any delays or errors.

Organize and Store W-2 Envelopes for Easy Access

Keep W-2 envelopes organized by labeling them with the tax year and recipient's name for quick reference. Store envelopes in a secure and accessible location to easily retrieve them when needed for tax reporting or document verification. Consider using a filing system or storage box to keep W-2 envelopes neatly organized and protected from damage.

Final Insights

W-2 envelopes are a critical tool for businesses and individuals during tax season, ensuring the secure distribution of important tax documents. By understanding the different types of W-2 envelopes available, real-world use cases, and how to effectively use and store them, individuals can streamline their tax preparation process and protect sensitive information. Utilizing W-2 envelopes is not only a best practice but also a necessary step in maintaining the confidentiality and accuracy of tax documents. Remember, when it comes to tax season, W-2 envelopes are an essential tool for success.